Competitive business environment = pressure on profits

If you sell on credit terms to B2B customers, it’s an inescapable fact that your business runs the risk of customer defaults or non-payment. In the increasingly competitive business environment, more pressure is being put on profits.

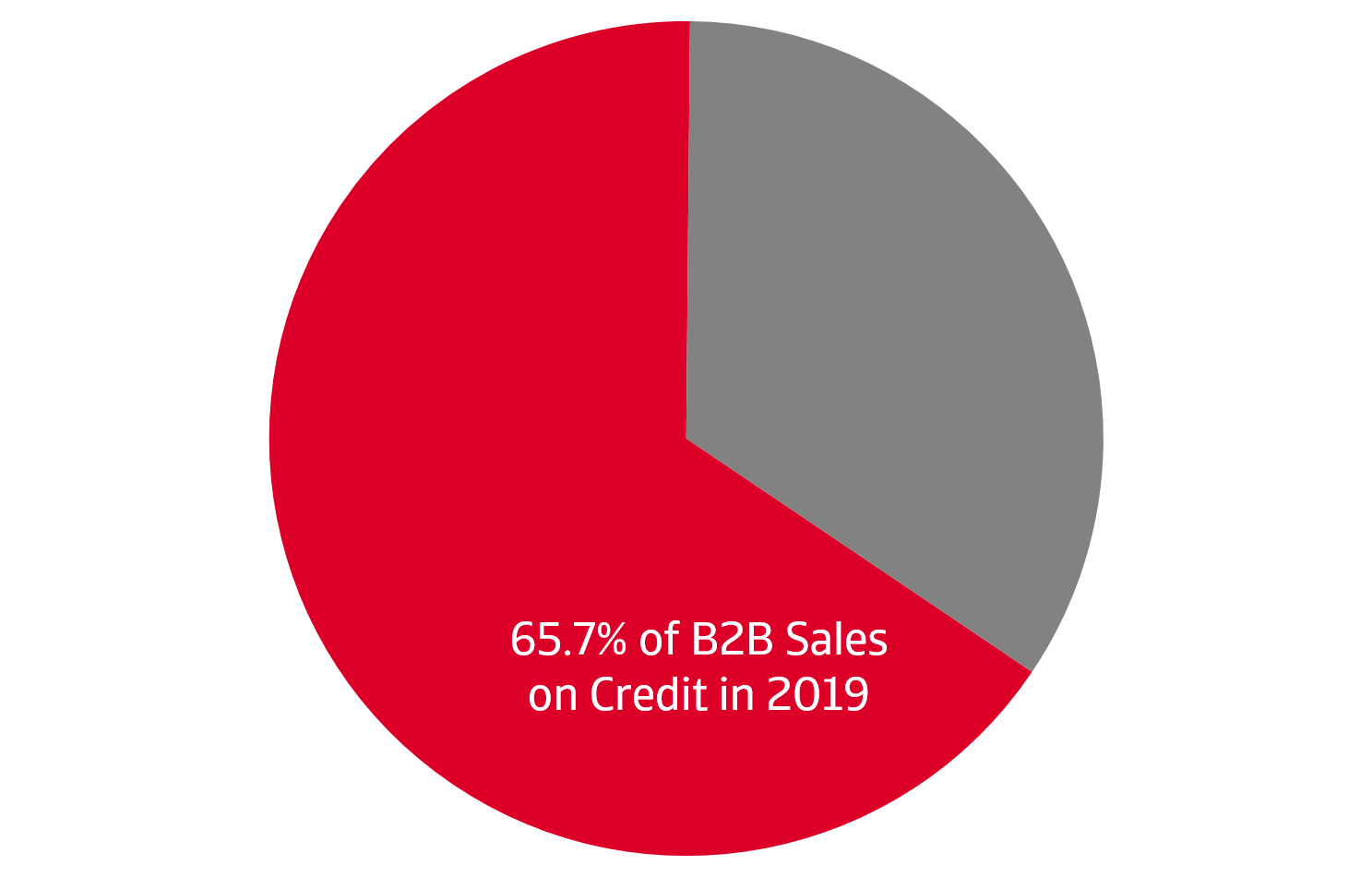

More businesses are selling on credit to keep sales up

To keep sales levels up, Singapore businesses have been offering B2B customers credit significantly more often than they had in the past with credit sales now amounting to 67.5% of the total value of B2B sales according to our latest Payment Practices Barometer.

This means bad debts are on the rise

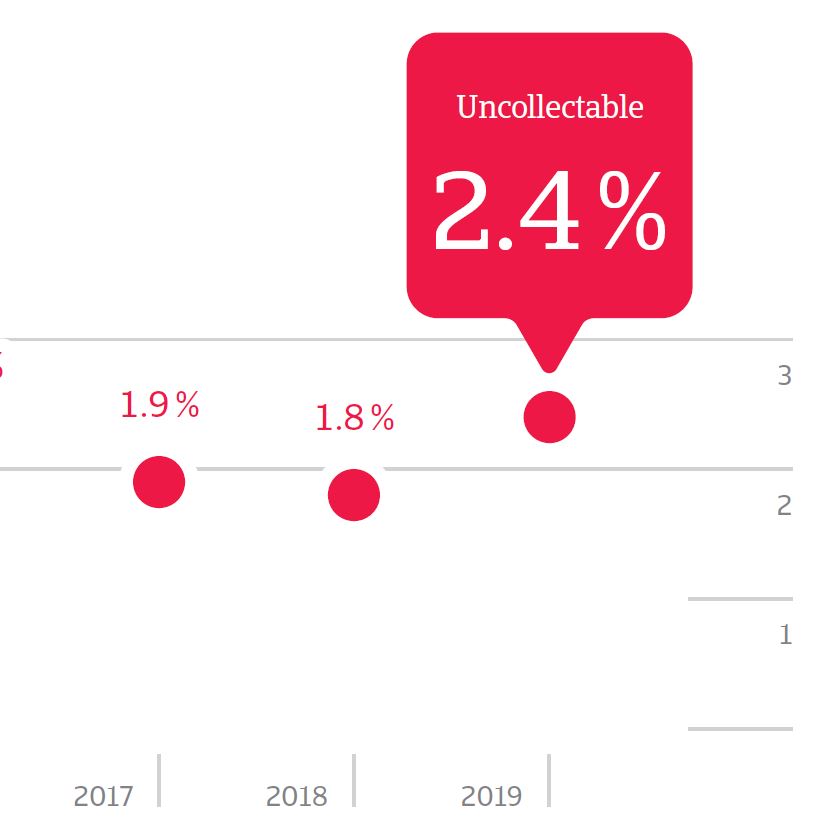

Unfortunately, not all creditors are able to honour their payments and bad debts written off as uncollectable have

increased over the past year to 1.8% compared to 2.4% previously.