Cash flow and margins of many automotive suppliers are under pressure

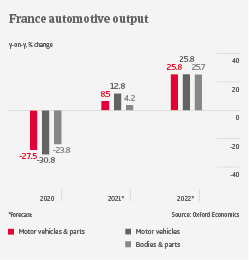

After contracting 27.5% in 2020, French automotive output is forecast to rebound by only 8.5% in 2021, as the current semiconductor shortage impacts production.

Original equipment manufacturers (OEMs) and larger Tier 1 suppliers still perform rather well in the currently difficult market environment, and remain financially resilient. However, the situation is different for Tier 2 & 3 suppliers, which had to cope with liquidity strains during the 2020 downturn. As the chip shortage has disturbed the supply chain, businesses in this segment face a lack of planning reliability. Additionally, suppliers suffer from increased raw material costs (e.g. metals and plastics) and higher energy prices. All this has a negative effect on cash flow and margins of many Tier 2 & 3 businesses, only partly mitigated by ongoing government support (e.g. furlough schemes lowering wage bills).

In the car dealers subsector, businesses selling second-hand cars and electrical vehicles are able to maintain profit margins. However, the whole segment is impacted by delays in new car deliveries and lower demand from companies. Additionally, OEMs are downsizing their sales networks.

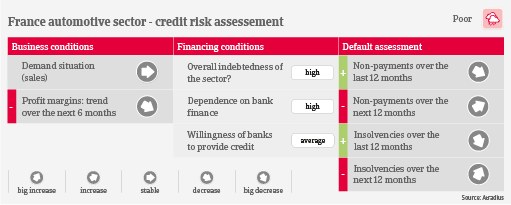

Payments in the industry take 60 days on average, and the number of non-payments and insolvencies has decreased since the spread of the coronavirus pandemic in early 2020, as massive government support (fiscal spending and tax breaks) have bolstered the financial strength of businesses. However, payment delays will rise in 2022, and business failures could increase up to 50% in the coming twelve months, mainly affecting smaller and medium-sized Tier 2 & 3 suppliers. The short-term credit risk in this segment largely depends on the duration of the current semiconductor shortage and the future development of raw materials prices.

Due to the ongoing shift towards e-mobility, those smaller suppliers that are heavily reliant on combustion engines (e.g. foundry work) will most probably have to leave the market in the coming years. Our underwriting stance remains generally restrictive for Tier 2 & 3 suppliers and car dealers.