Internal demand & export growth work in favor of Indian B2B credit sales, but future trends of B2B payment practices affecting business confidence in India.

India will remain on a high growth path this year. Export growth is expected to be in the region of 6.6%. Real GDP growth is forecast to reach a healthy 7.2%, mostly due to private consumption picking up. However optimistic this picture may seem, the recent downward revision of India’s growth forecast points to strong headwinds in the short term.

B2B credit sales on the rise, due to a pick up in internal demand and export growth

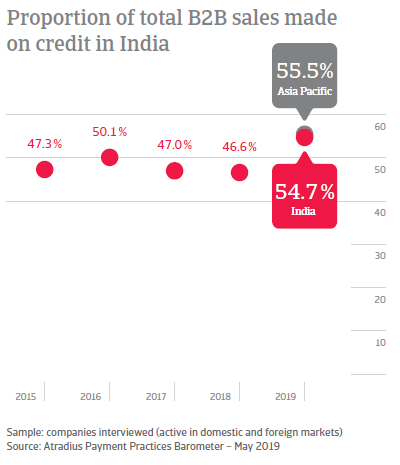

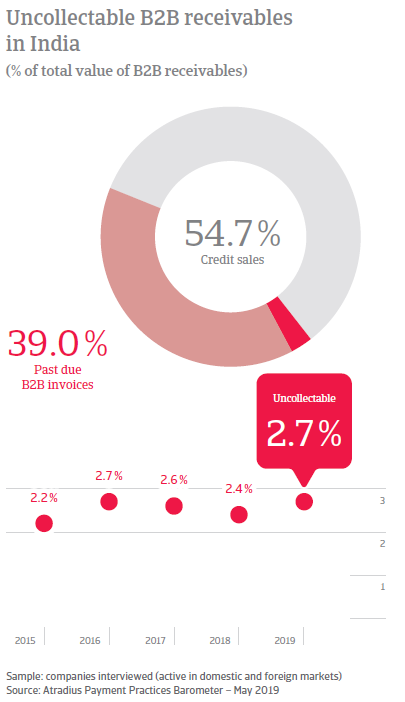

In line with regional observations, survey respondents in India appear notably more likely than last year to sell on credit terms than on a cash basis to their B2B customers. Current survey data revel that there was an increase of approximately 17% in the volume of B2B sales transacted on credit terms over the past year. 54.7% of the total value of Indian respondents’ B2B sales was transacted on credit (up from 46.6% last year) while 45.3% was made on a cash basis (down from 53.4% one year ago). These figures suggest that Indian respondents are adopting a more liberal trade credit policy to protect their competitive position, both on the domestic and on export markets.

Invoice to cash turnaround significantly faster than one year ago

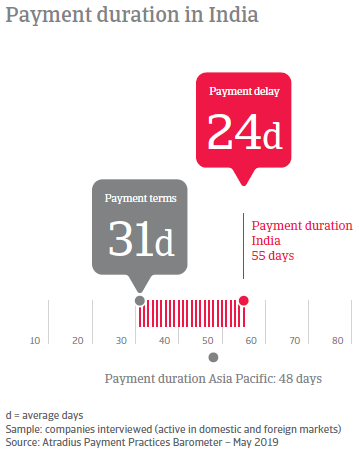

The increase in sales transacted on credit observed in India does not appear to be underpinned by the extension of more relaxed payment terms from respondents. On the contrary, as survey findings reveal, payment of invoices is requested, on average, 2 days faster than a year ago, namely within an average of 31 days from the invoice date. This is one day less than the average 32 days for the region). As observed across many of the countries surveyed in Asia Pacific, the shorter credit terms given to B2B customers are indicative of a stronger perception of the customers’ payment default risk. This reflects the more uncertain trading environment. However, due to the interplay between more stringent credit terms and faster settlement of invoices from B2B customers, respondents in India are now able to turn past due invoices into cash on average in 55 days, approximately two weeks sooner than last year.

Indian businesses more likely to hedge against exchange rate risk then businesses in other Asia Pacific countries

Connected with the markedly more extensive use of trade credit in B2B transactions domestically and abroad, there is strong awareness among Indian respondents of the risk of payment default arising from trading on credit in a challenging business environment. This is reflected in the balanced mix of credit management practices many Indian respondents (on average 35%) reported they employ in their common business practices. These practices range from the assessment of the prospective buyer’s financial profile prior to any trade credit decision, to the offering of discounts for earlier payment of invoices. It is worth noting that hedging against exchange rate risk (to protect the business against the weakening of the rupee) as well as using specific credit management software are done markedly more often in India (31% of respondents) than in the region overall (19%).

Knock on effect of late payment in India stronger than in other Asia Pacific countries

An average 39.0% of the total value of B2B invoices issued by Indian respondents remained unpaid at the due date. This is well above the 29.8% average for Asia Pacific. In order to remain financially flexible, and to alleviate the financial pressure on the business, more respondents in India (51%) than in Asia Pacific overall (41%) reported they needed to delay payment of invoices to their own suppliers. 49% of respondents in India, compared to 39% in the region, said they had to stabilize cash flow. 47% (versus 29% at regional level) had to pursue additional financing from external sources such as banks or factors. Despite the balanced mix of credit management techniques used, the proportion of bad debts written off as uncollectable (2.7%) increased compared to last year’s 2.5%. This compares to a 2.1% regional average.

Respondents in India the most pessimistic in Asia Pacific about the trend of customers’ payment practices over the next 12 months

Respondents in India appear to be the most pessimistic in Asia Pacific about the future trend of customers’ payment practices. 53% of Indian respondents (compared to 30% at regional level) anticipate deterioration in their B2B customers’ payment practices over the coming months. An improvement is expected by 27% of respondents (compared with 22% in Asia Pacific overall), while 20% (47% in the region) do not foresee any variation in the short-term. Given this pessimistic view, 43% of respondents plan on taking more action to limit the impact of deteriorating payment behaviour. These actions include, amongst others, reserving against bad debts (44% of respondents), reducing reliance on a single buyer (42%), more active dunning (outstanding invoice reminders) and beginning to use credit insurance (in both cases 24% of respondents).

Overview of payment practices in India

By business sector

Average payment terms longest in the services, consumer durables and construction sectors. Shortest in the wholesale/retail/distribution, agri-food and ICT/electronics sectors

Respondents from the services, the consumer durables and construction sectors extended the longest average payment terms to their B2B customers (each averaging 35 days from the invoice date). Respondents in the wholesale/retail/distribution, agri-food and ICT/electronics sectors extended the shortest average payment terms (averaging 22 days each).

Financial impact of late payments most acutely felt in both the services and ICT/electronics sectors

The services and ICT/electronics sectors are the most impacted by late payments from B2B customers. The value of overdue invoices in both sectors averages 42% of the total value of respondents’ B2B invoices. This compares to an average of 38% for both the manufacturing and the wholesale/retail/distribution sectors. At 35%, both the consumer durables and the chemicals sectors recorded the lowest average value.

Growing companies are undoubtedly some of the businesses that can benefit most from the protection credit insurance offers.

Highest percentage of bad debts written off as uncollectable in the services and the ICT/electronics sectors

With an average of 3.3% of B2B receivables written off as uncollectable, both the services and ICT/electronics sectors appear to be the most impacted by bad debts. The average in both the manufacturing and the wholesale/retail/distribution sectors is 2.6%. The 2.7% average in the machines sector matched that of the country overall. The 2.1% average in the metals sector reported the lowest of the business sectors surveyed in India

By business size

SMEs on average extended the most relaxed payment terms to B2B customers

Respondents from SMEs in India extended the longest and from large enterprises the shortest average payment terms to B2B customers (averaging 35 days and 17 days from the invoice date respectively).

Micro-enterprises wait the longest to turn overdue invoices into cash

Over the past year, SMEs in India recorded the most significant improvement in B2B customers payment timings (20% increase in invoices paid on time). Due to this improvement, overdue invoices in Indian SMEs now account for 37.6% of the total value of B2B invoices. This compares to an average 43.4 reported by respondents from micro-enterprises and to 36.2% reported by respondents from large enterprises. The average time it takes to convert invoices into cash is 59 days from the invoice date for micro-enterprises, 57 days for SMEs and 47 days for large-enterprises.

Bad debts written off at highest rate in large enterprises

Large enterprises in India recorded the highest proportion of B2B receivables written off as uncollectable (2.8%). The average for both micro-enterprises and SMEs is 2.6%.