Our experienced debt collections team, Atradius Collections, are located throughout the world to support your collection of outstanding invoices in any country, time zone, currency and language.

As an Atradius customer, you’re automatically able to access and benefit from our debt collections service, Atradius Collections. This is a feature of all our Credit Insurance policies and will not incur any additional cost for you.

We also offer a standalone Atradius Collections service to organisations and business that are not Atradius Credit Insurance customers.

As debt collections specialists, we know how to respond to excuses for non-payment and exert the right level of pressure to maximise revenue collection.

We also know that a proactive and sensitive approach can often yield the best results. A payment plan for a customer experiencing cashflow problems may result in complete settlement of the debt and the retention of a strong working relationship with you. To that end, we work closely with you to seek the quickest and most appropriate solution for you.

"Atradius Collections supported us in a few cases when the relation with some customers became problematic."

With the benefit of our worldwide IT infrastructure, we operate the most integrated Collections network in the industry. Our fully automated approach allows us to act promptly upon receipt of a notification of non-payment, regardless of time zones.

We’re able to support you wherever you trade in the world, with our teams of locally based multilingual Collections specialists.

Policy holders may benefit from our Collections services at no extra cost as an integral part of their policy. As a policy holder you may manage this through Atradius Atrium.

Non-policy holders may also access our collections expertise on a case by case basis. As an Atradius Collections-only client, you may track your case through our dedicated system, Collect@Net.

Load more

Viewing out of

The first ever online e-commerce debt recovery platform is now available to you.

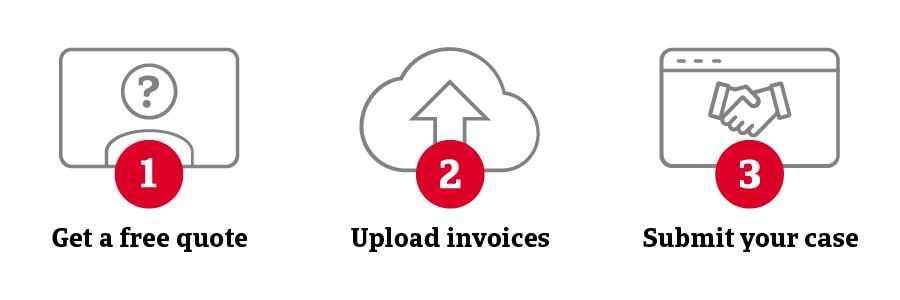

Easily collect your debts online. With our online platform, you simply upload your unpaid invoices, monitor our collection process and receive your money as soon as the debt is recovered.

What are the benefits?

- Get an instant, obligation-free quote

- Submit multiple collection cases

- Stay updated on the collection progress 24/7

Contact us