Chinese chemicals output decreased in Q2 of 2022, due to lockdowns in Shanghai and several other cities/regions which are major hubs for chemicals production. Many producers had to temporarily cease operations and faced supply chain disruptions. The lockdowns also negatively affected chemicals demand from households and key buyer industries like automotive.

Since Q3 of 2022 chemical production and sales have rebounded, as lockdowns have been eased and the economy recovered. However, demand remains subdued due to the looming downside risk of renewed Covid-related restrictions.

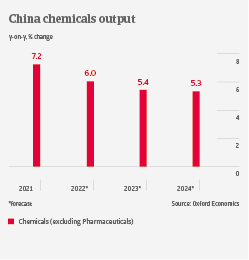

Overall margins of chemical businesses decreased in Q1-Q3 of 2022, due to increased energy and raw material costs. We expect no substantial improvement of profit margins in 2023. The lockdowns and supply chain disruptions in H1 of 2022 triggered liquidity issues for many businesses, and we observed an increase in payment delays and non-payments. We expect non-payment and insolvencies will increase by 5%-10% in the coming 12 months. This is because economic growth is forecast to slow from 8.1% in 2021 to 3.2% in 2022 and 4.9% in 2023 while the global demand for chemicals remains subdued. Covid-related restrictions continue to affect economic activity, although authorities have fine-tuned the zero-Covid policy in order to reduce supply-side disruptions.

Among subsectors, the credit risk is highest for paints and coatings. Businesses in this segment have suffered losses due to high commodity prices and deteriorating demand from the ailing property market. That said, the agrochemical subsector is expanding, with China being a global key producer and export center for agrochemicals. Basic chemicals have shown an upward trend of sales this year but could face weaker demand and oil price volatility in the coming months.

Tighter environmental rules have been introduced since 2015, aimed at upgrading green technology innovation. High emitters have been gradually phased out, and such closures will continue. Given higher environmental standards and related cost increases, small and medium-sized chemical businesses could face problems in the short-term.