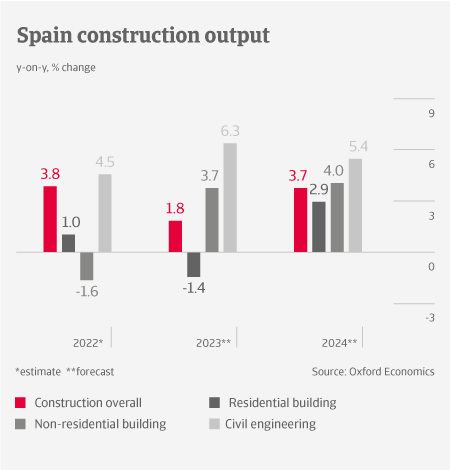

Construction output in Spain is forecast to grow by just 1.8% in 2023, as interest rate increases hamper building projects across all subsectors. The residential construction segment will contract as a combination of higher interest rates and lower disposable household incomes negatively affect access to affordable mortgages. While the Next Generation EU fund will support large investments in projects with a sustainability aspect, its implementation has been slower than expected so far.

Construction output in Spain is forecast to grow by just 1.8% in 2023, as interest rate increases hamper building projects across all subsectors. The residential construction segment will contract as a combination of higher interest rates and lower disposable household incomes negatively affect access to affordable mortgages. While the Next Generation EU fund will support large investments in projects with a sustainability aspect, its implementation has been slower than expected so far.

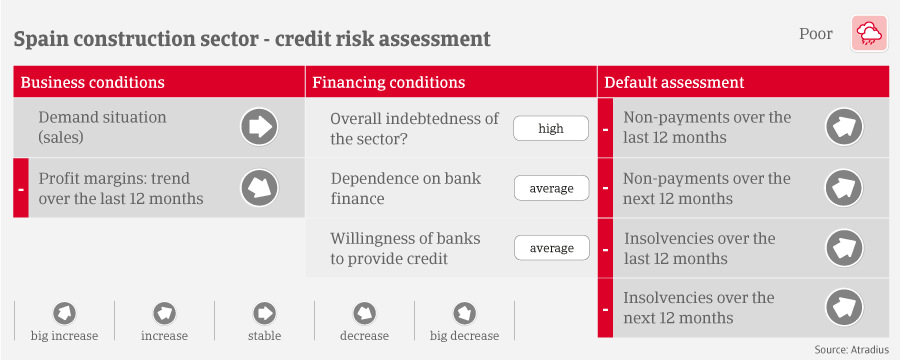

Higher prices for energy and construction materials additionally weigh on activity and margins of businesses. Mainly affected are builders involved in new residential construction, because they struggle to pass on higher input prices to end-customers. The situation seems better for builders with public contracts because the Spanish government wants to mitigate the consequences of raw material price increases for businesses.

Higher prices for energy and construction materials additionally weigh on activity and margins of businesses. Mainly affected are builders involved in new residential construction, because they struggle to pass on higher input prices to end-customers. The situation seems better for builders with public contracts because the Spanish government wants to mitigate the consequences of raw material price increases for businesses.

The Spanish construction sector is characterised by long payment terms, mainly from large groups and companies, at the expense of smaller businesses in the value chain. The average duration amounts to about 100-120 days. The number of protracted payments is generally elevated due to public clients with long payment periods, and frequent disputes about materials, installations, etc. Payment delays increased in 2022, and we expect this negative trend to continue in 2023. Higher financing costs, as well as increased raw materials and energy prices, continue to constrain the liquidity of businesses, making it more difficult for them to meet payment obligations on time.

Construction insolvencies increased 30% year-on-year in the period of January-November 2022, in part because a pandemic-related bankruptcy moratorium expired at the end of June 2022. We expect further rising construction business failures this year, with smaller businesses active in residential construction facing the highest risk.

Due to the subdued credit risk situation, cost pressure and weaker demand for residential construction we assess the sector as “Poor”. Shortage of skilled workforce will remain an issue in the mid-term, with the National Confederation of Construction estimating that Spain requires about 700,000 construction workers during the next couple of years.