Our Atradius Exclusive series will provide you with the latest insights from Atradius Economists, annual reviews of corporate payment practices, sector performance and more.

Publications

Reports and whitepapers from our industry experts

News

Latest news and insights

Blogs

Latest blogs

Resources

Helpful guides at your fingertips

FAQs

Your questions answered

Case studies

Examples of high quality credit management processes and practices

Testimonials

Success stories from our diverse range of clients

Report

B2B payment practices trends in Spain 2025

Our survey of Spain reveals that companies across industries are increasingly concerned about B2B customer financial resilience amid rising insolvency risks and economic uncertainty

Report

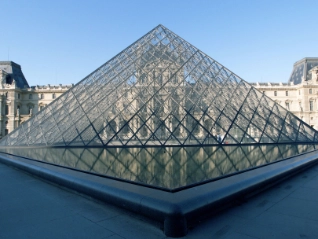

B2B payment practices trends in France 2025

Our survey of companies in France reveals that financial headwinds are mounting as B2B customer payment risk looms

Report

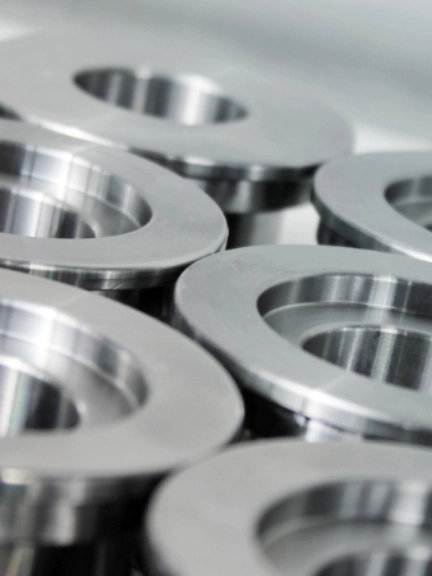

Global Metals and Steel Industry Trends 2025/2026

Challenges currently impacting the global metals and steel industry include oversupply, clean energy transition with the increasing demand for green steel, and US tariffs

Report

B2B payment practices trends in United Kingdom 2025

Our survey of companies across United Kingdom reveals how B2B payment delays remain a major concern amid a perfect storm of financial challenges.

Report

B2B payment practices trends in Germany 2025

Our survey of companies across Germany reveals that businesses are adjusting their working capital management strategies to weather the impact of trade turbulence on operations and finances

Report

B2B payment practices trends in the Netherlands 2025

Our survey of companies across the Netherlands reveals that Dutch companies focus on payment risk mitigation in B2B transactions as trade disruptions ramp up

Report

B2B payment practices trends in Western Europe 2025

Our survey of companies across Western Europe reveals growing anxiety about bad debts amid an unpredictable customer payment risk landscape

Load more

Viewing 7 out of 164

News

How is Western Europe managing cash flow stress these days?

With the economy feeling uncertain, businesses across Western Europe are adapting their payment risk management strategies to stay strong and steady in the months ahead.

News

Exploring global insolvency frameworks

Atradius' Special Risk Management and Underwriting experts have updated their Insolvency Framework whitepaper, focusing now on 39 of the world's key markets.

News

Germany faces the challenge of maintaining its global competitiveness

Atradius points to the labour force, technological innovation and international relations as the three main keys that will determine the future of Germany's economic performance.

News

EU focuses on free trade as it seeks order from chaos

President Trump’s weaponisation of tariffs may give the EU the push it needs to get major free trade agreements over the line

News

How businesses are preparing for the fallout of a trade war

As global trade faces mounting pressure from rising tariffs and economic uncertainty, credit insurance is poised to become an essential tool for businesses engaged in international commerce.

News

EU economies brace as Washington and Brussels trade tariffs

The US has slapped tariffs on metals and EU retaliation is on its way, so what impact might a transatlantic trade war have?

News

Atradius closes 2024 with a profit of EUR 392.3 million, up 5.4%

We navigated another year of evolving global challenges to deliver a solid performance.

Load more

Viewing 7 out of 37

Blog

Insights into the Global Economy

Blog

Buyer Fraud: How to avoid getting caught out

Blog

4 tips on how to limit bad debt losses during times of economic stress

Blog

Managing credit risk in uncertain times

Blog

Credit risk management: Choosing the right solution

Blog

Credit insurance: A holistic risk management solution

Blog

Bank guarantees: Facilitating and securing high-value transactions

Load more

Viewing 7 out of 26

Subscribe to our newsletter

Keep your finger on the world's economic pulse

Click to Subscribe

Resource

Driving agile transformations in credit insurance

Resource

Bad Debt: A comprehensive guide

Bad debts are not just an accounting issue, but a threat to your financial health

Resource

The future of Credit Insurance: Embracing AI for strategic advantage

Resource

How can Retention of Title protect your business?

Using a German example, this article delves into the concept, benefits, and real-world practice of Retention of Title (RoT) to demonstrate how it can best safeguard your interests as a supplier.

Resource

Letters of credit

Letters of credit are bank guarantees to pay a seller (usually an exporter) for goods or services that the seller has shipped to a buyer (usually an importer).

Resource

Early detection of default risks

Insolvencies often happen when an important business partner folds. Particularly small and medium-sized enterprises with capital ratios of less than 20% can fall victim to this domino effect.

Resource

How to do a risk assessment of your accounts receivable

Your company's accounts receivable is an important indicator for assessing business health.

Load more

Viewing 7 out of 16

Frequently Asked Questions about credit insurance, how it works and how it can benefit your business.

- What is trade credit insurance?

- What is credit risk?

- Why credit management is important?

- What is business insurance?

- SME Insurance Singapore

- What is debt recovery?

- What is export credit insurance?

- What is political risk insurance?

- How much does credit insurance cost?

- How can I reduce DSO?

- How can I insure my export trade credit?

- How do you know if a business is failing?

- Why do traders take out credit insurance

Case Study

Park Polymers: Credit Insurance for Risk Management and Growth

Case Study

EnCom Polymers: credit management for chemicals sector

With the backing of Atradius’s resources, EnCom Polymers has been able to expand business with existing customers and go after new business they previously would have shied away from.

Case Study

BVV GmbH: credit management for steel processing

BVV GmbH grew internationally and recognised risks such as companies on the brink of insolvency in plenty of time to mitigate the risks.

Case Study

Vinci Construction: credit management for the construction sector

Atradius Surety has enabled Vinci Construction France to expand their sources of finance beyond their banking partners. This partnership with Atradius benefits Vinci Construction by providing substantial flexibility, excellent responsiveness and a capacity for innovation.

Case Study

Continental Banden: credit management for the automotive parts sector

How we are part of Continental Banden Groep B.V.'s business process, minimising risk and supporting sales

Case Study

Metalco Inc.: Driving new business with quick communication

Ben Green, President and Owner at Metalco Incorporated in Chicago, Illinois, explains how Atradius Trade Credit Insurance has helped him secure new business confidently.

Case Study

L'Oreal: credit management for the beauty sector

As a successful business, L’Oréal Hong Kong wanted a partner that could help protect their regional interests and support their focus on further growth.

Testimonial

Omron - electric machinery sector

Omron has achieved sustainable growth while navigating the uncertainties of China-US trade relations and regional manufacturing transformation.

Testimonial

Ferm - machines sector

FERM (International) offers competitive payment terms and limits their credit risk to developing countries by using Atradius Dutch State Business (DSB) and the DGGF.

Testimonial

El Ganso - retail fashion sector

El Ganso credits our support in helping the fashion brand grow from a domestic-focused Spanish startup to a successful international business.

Testimonial

Calidad Pascual - beverages sector

Calidad Pascual partners with international credit insurance firm Crédito y Caución Atradius to gain additional knowledge of international markets.

Testimonial

Brook Green Supply - energy supply sector

By providing open dialogue, insight and valuable credit information we helped Brook Green Supply improve their internal credit risk management systems.

Testimonial

Janson Bridging - infrastructure sector

Janson Bridging (International) uses export credit insurance from Atradius Dutch State Business (DSB) to offer favourable credit terms to customers located in emerging markets.

Testimonial

Georg Jensen Damask - textile sector

Our agility and local knowledge of worldwide markets and buyers are key reasons why textiles business Georg Jensen Damask say they collaborate with us.

Load more

Viewing 7 out of 9

Case study

Metalco Inc.: Driving new business with quick communication

Ben Green, President and Owner at Metalco Incorporated in Chicago, Illinois, explains how Atradius Trade Credit Insurance has helped him secure new business confidently.

ExploreTools

Insights to elevate your strategic growth